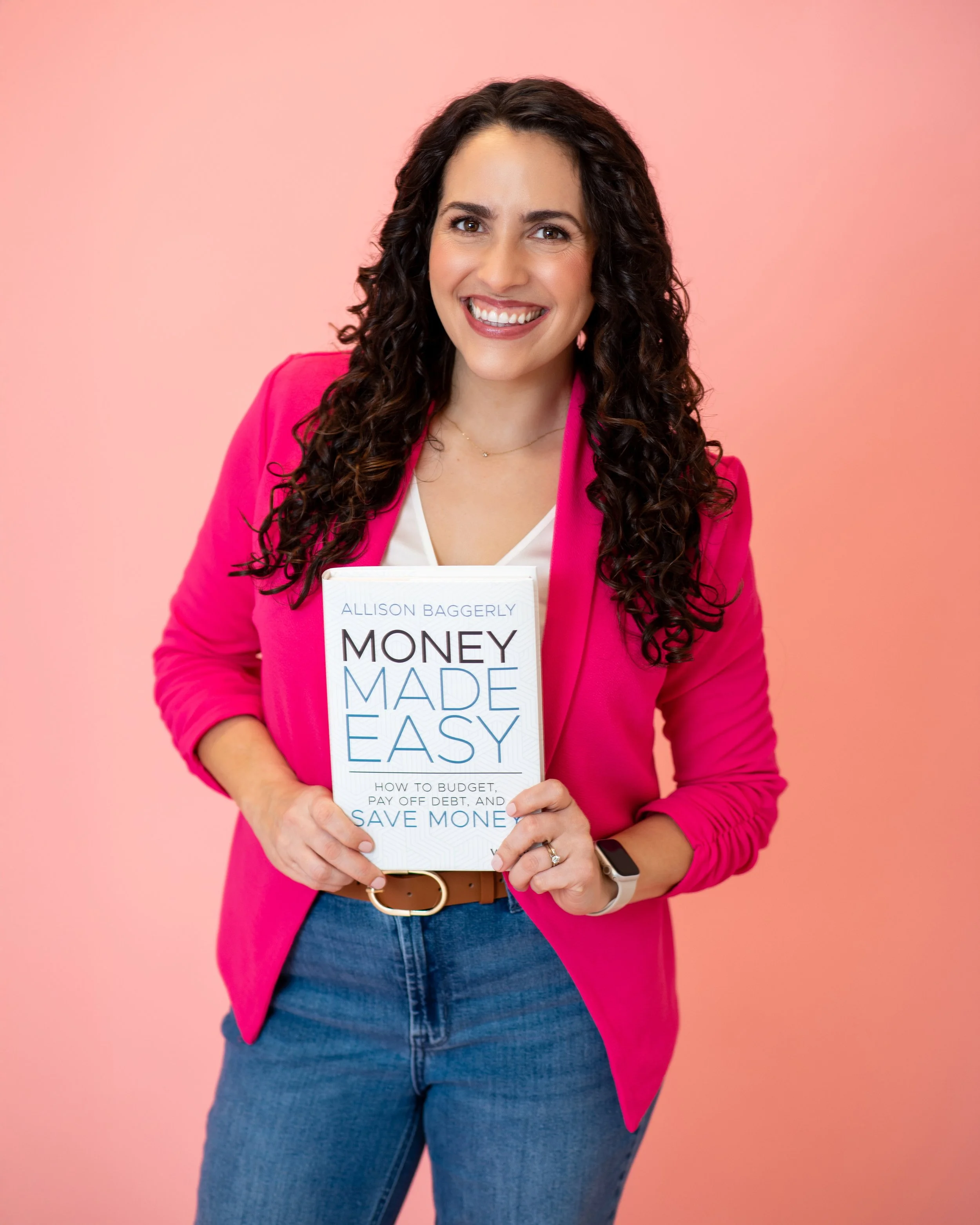

HERstory in Portraits: Allison

Empowering Women, One Choice at a Time

Women are driving change in communities, businesses, and entire industries across Texas. Their leadership often happens behind the scenes – around kitchen tables, in moments of crisis, or in the quiet determination to build a better life for their families. Too often, these acts go unrecognized. HERstory in Portraits exists to change that.

Today, we’re shining a light on a woman who turned her own financial struggles into a mission that now reaches millions: Allison Baggerly, founder of Inspired Budget and a leading voice for women seeking financial clarity and confidence.

Allison’s story didn’t begin with spreadsheets or business plans. It began, as many transformative journeys do, with a moment of reckoning.

From Overwhelmed to Empowered:

The Beginning of Her Money Story

At 24 years old, Allison was newly married, expecting her first child, and like many young couples, avoiding conversations about money. The shift happened the day she and her husband sat down to figure out how they would pay for childcare.

“When we added everything up, we saw we had $111,000 of debt,” she recalls. “Our minimum monthly payments alone were over $1,400. Just trying to afford daycare was the catalyst for changing everything.”

At first, Allison approached budgeting as a temporary sacrifice – something she’d do only until the debt disappeared. But life had other plans. Over the next 4.5 years (and having two children during that time), as they steadily payed down their debt, something shifted.

“My habits and values changed,” she says. “I fell in love with the control that budgeting gave me.”

They finished paying off their debt in 2016, and the following year Allison launched Inspired Budget as a simple blog. Over years, it has grown into a full financial education platform complete with a website, resources, programs, a book, YouTube videos, and a podcast with more than 1.5 million downloads, all allowing her to reach women wherever they are.

Her mission is both deeply personal and powerfully universal: to help women who feel exactly the way she once felt – stressed, overwhelmed, living paycheck to paycheck – gain the tools to rewrite their story.

The Moment Everything Changed

Allison is the first to admit she didn’t grow up learning how to manage money. Even in college, once she started managing her money, she had only one financial goal: don’t let the account go negative.

But one day, it did.

“I remember checking my bank balance online and thinking I had plenty of money,” she says. “The next day I went to HEB for groceries, and my card declined. I swiped it three times thinking it was an error. I ended up leaving my groceries behind.”

Only after the embarrassment and confusion settled did she realize what happened – her rent check had cleared.

She drove home and called her mom, who responded with the kind of loving accountability that changes lives. She told her to come home. She said they would figure it all out, but they were going to lay everything out and look at where her money was actually going.

“That moment was pivotal,” Allison says. “It forced me to start being intentional about money instead of just hoping for the best.”

Why She Focuses on Women

Inspired Budget’s community reaches people of all ages, from their mid-20s to their late 60s, and from every corner of the globe. But Allison’s work intentionally centers women.

“Women are often the ones managing the household finances,” she says. “When women have more information, more competence, and more resilience, it’s a better world.”

She also knows firsthand how isolating it can feel to shoulder financial stress, especially while juggling motherhood, relationships, and work.

Her goal is simple and profound: to help women feel capable, informed, and in control.

What People Get Wrong About Money

Allison has coached thousands of women. And she’s noticed a pattern in how many people approach budgeting.

“One of the biggest mistakes people make is trying to overhaul their entire life in January,” she explains. “They cut out restaurants, promise not to spend anything extra, create a budget for a life they think they should want, but it’s just not sustainable. Who wants that life?”

The result? Burnout, shame, and a quick return to old spending habits.

Instead, Allison teaches that awareness comes first. Then small, meaningful changes.

“We need to figure out your spending before we can fix anything,” she says. “So many people start by just making assumptions about where their money has been going.”

She says two of the most common blind spots are food (takeout, groceries, delivery apps, fast food – all added together) and online shopping (especially Amazon, where it can show up on a statement as just “Amazon” so you don’t even remember what it was for, and whether it was a household necessity like toothpaste or pet food vs. a splurge, which makes accountability extra difficult).

Her message is hopeful: once you see your patterns clearly, you can finally change them.

How She Helps Women Build a New Financial Future

For anyone beginning their financial journey, Allison offers countless free resources via her blog, podcast, and YouTube channel, all designed to help women feel seen and supported.

Ultimately, transformation isn’t about information alone, it’s about habits. “We can have all the info in the world,” she says, “but we have to keep changing our habits. That’s how you change your life.”

For those who want a step-by-step plan and personal guidance, she offers the Inspired Budget Inner Circle, a membership experience that includes:

A structured pathway to follow

Clear action steps for each stage

Monthly live coaching calls

A private accountability group

Direct access for specific questions

Most members work with her for about a year.

She also points out something interesting: “Single women typically need less time because there’s only one decision-maker,” she says. “When they commit to tackling their debt and changing their financial life, they don’t have to convince anyone else.”

Why HERstory Matters

Allison’s journey is exactly what HERstory in Portraits celebrates: the power of women who turn struggle into wisdom, and wisdom into impact.

Her work doesn’t happen in boardrooms or executive suites, it happens in moments of honesty, in tough conversations about spending, in the courage to open a bank statement that feels overwhelming. In knowing her kids will never have to have that moment of shame leaving their needed groceries behind because they’re talking about money early.

Her story reminds us that leadership doesn’t always look like what we expect. Sometimes it looks like a young mom sitting at her kitchen table with a calculator and a promise to do better. Sometimes it looks like a woman choosing to share her story so others won’t feel alone. And sometimes it looks like a global community of women learning, step by step, that they can rewrite their financial future.

With empathy, clarity, and a mission rooted in her own experience, Allison Baggerly is helping women across the world build confidence one budget, one habit, one brave decision at a time.

That’s HERstory. And it’s worth celebrating.